National Webinar on “Strategy for Managing Personal Finance”

Association of Mutual Fund of India

National Webinar on “Strategy for Managing Personal Finance”

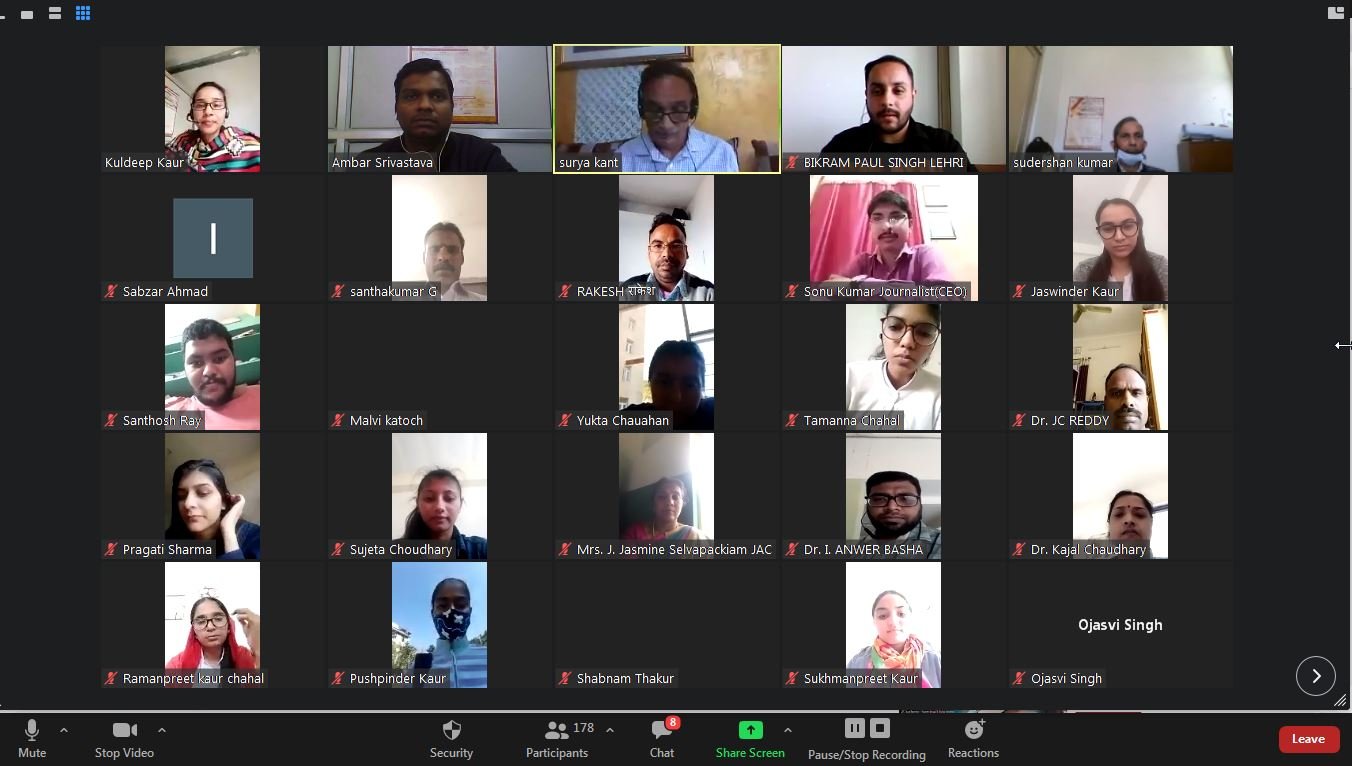

National webinar entitled above was organized by the Akal College of Economics, Commerce and Management on 25th October, 2021 in collaboration with Association of Mutual Fund of India (AMFI). The webinar was attended by more than 250 participants from various parts of the country.

The webinar was inaugurated by Mr. Ambar Srivastava with briefly introducing about the objectives of the webinar. Then, Dean of the college, Dr. S K Chauhan enthusiastically welcomed Mr. Deb Bhattacharjee & Mr. Surya Kant Sharma, the resource person and all participants. In his short welcome address, he gave a brief introduction of Eternal University and about the demography and economy of Himachal Pradesh.

Afterwards, Mr. Bhattacharjee (Assistant General Manager at Securities and Exchange Board of India) guest speaker, talked about mutual funds, KYC, various types of investors and benefits of diversification.

Then, Shri Surya Kant Sharma, (Senior Consultant AMFI) who was keynote speaker in the webinar at the outset touched upon the importance of financial security of individuals. He emphasized that an investor should first think and ensure adequate life insurance, reasonable medical insurance cover and an emergency fund before embarking upon the journey of wealth creation through sustained investments which is most essential for prosperity. He then made a vehement plea for regular savings and increase of savings every year minimum by 10%. He then dealt in detail on the need for wealth creation for prosperity and emphasised that investors should not be money accumulator but wealth creator which only would make them comfortable with regard to their money needs for their milestones in life.

He then advised participants that they should look at real return and not on notional return as inflation and tax liability substantially takes away major portion of notional return. He cautioned participants that most of the investments except in governmental shames have risk but risk can be managed by simple formula – Think, understand and invest. He also emphasized the need to have financial planning of their families in place for focused investment and also the need for practicing rule of compounding in investments for higher return in long run.

He then shared basic information on various investment avenues available in the market viz. Government/RBI bonds, corporate bonds, Government schemes (Post office schemes, PPF, NPS, securities market etc. real estate, gold and securities market. All these avenues are different and have distinct features and investors should investment their hard earned money according to his/her risk apatite and time horizon of investment.

Shri Sharma cautioned general investor not to enter into securities market directly as there are inherent risks in the market and unless the investor have sound knowledge of market, sectors, economy, international economy etc. he should desist from entering into the market directly. Instead, mutual funds are the best option available for general investor wherein he/she can invest a minimum amount of Rs.500/- though Systematic Investment Plan (SIP) and built a good corpus over a period of time. He also mentioned that in mutual funds there are number of shames as per risk apatite and time horizon of investors. There is a wide spectrum of mutual funds schemes ranging from equity funds to debt funds to exchange traded funds which can be chosen by an investor as per his risk apatite and investment horizon.

At the end, he emphatically cautioned participants not to invest their hard earned money on the advice of others including agents and never never in unregulated fund mobilisation schemes – Ponzi scheme, chit funds and committees etc. - which give assurance for higher and quick return at the beginning but ultimately vanish with the hard earned money of investors. Not so affluent class of investors are more susceptible to such allurement and we all have a social responsibility to make them aware about the menace of such schemes and impress upon them not to invest their money in such schemes. He also informed that as per a survey, investors have lost more than ten lakh crores of rupees in such unregulated fund mobilisation schemes.

After the sessions, a question answer session was made open for the participants and participants asked lot of questions on personal finance which were satisfactorily answered by the experts.

In the end, Mr. Srivastava and Ms. Kuldeep Kaur expressed vote of thanks to the expert, participants, the Dean of the college and administration. The participants who filled in feedback proforma were issued online certificates.